Bond issues

The needs of asset financing are covered with outside resources from the financial markets, the two main sources being bilateral loans with financial entities and issues of obligations or bonds.

Since it was founded, CORES has issued bonds six times between 2003 and 2017.

The first bond issue was in 2003, for the amount of EUR 350 million, with a 10-year term and a foreign level of demand of approximately 80%.

In 2008 the second transaction was placed in the markets for a total of EUR 500 million, with a 10-year term. As occurred with the previous issue, there was a high level of foreign demand.

In order to cover the maturity of the 2003 issue, a third bond issue was launched in 2013 for an amount of EUR 350 million and a 3-year maturity date. In this issue there were a total of 90 orders recorded, for a book volume of up to 825 million euros.

The fourth bond issue was in October 2014 for an amount of EUR 250 million and 10-year term. 2.6 times oversubscription allowed CORES to print a no-grow trade at SPGB +39 bps.

The fifth bond issue was in November 2015 for an amount of EUR 350 million and 7-year term. 2 times oversubscription allowed CORES to print a no-grow trade at SPGB +41 bps, the lowest coupon ever paid by CORES (1.5%).

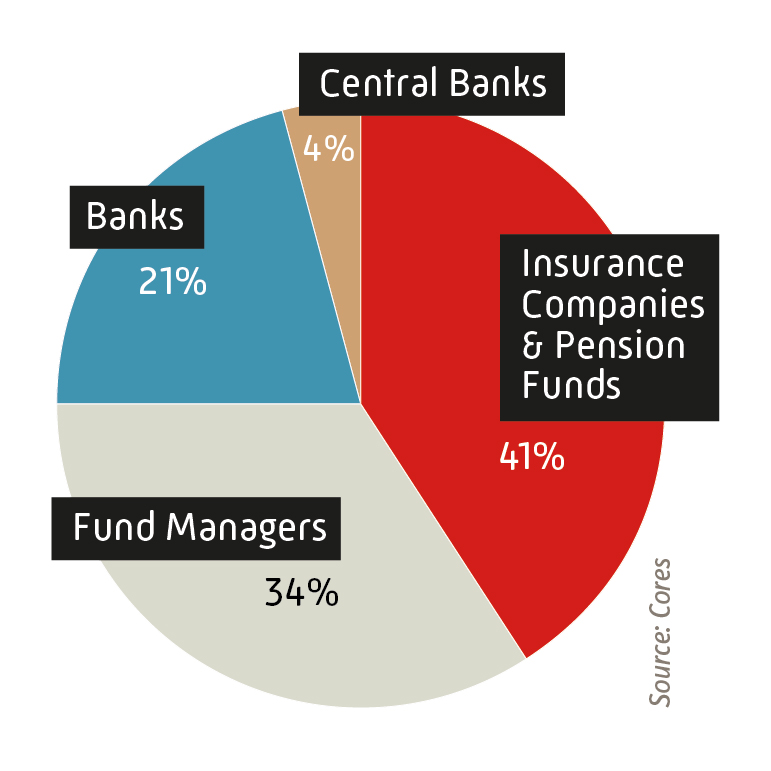

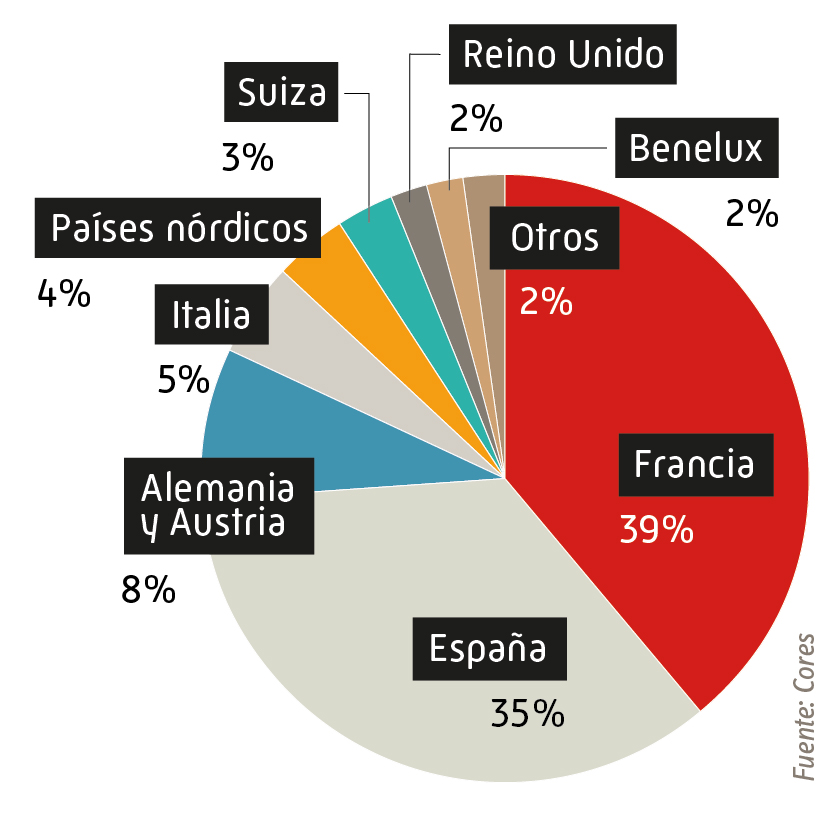

Finally, in November 2017, the sixth bond issue was carried out for an amount of EUR 400 million and a 10-year term. The good acceptance among investors made it possible to close the transaction with a spread of 28 basis points over the Spanish Treasury. The investment base hwas mostly international, with France standing out (39%). A breakdown by investor type revealed a division between insurance companies/pension funds (41%), fund managers (34%), banks (21%), central banks (4%).

Currently, CORES has a single outstanding bond admitted for trading on secondary markets, with the following characteristics:

| Type of issue | Issue date | Outstanding balance (millions €) |

Maturity date | Interest rate | Markets where listed |

|---|---|---|---|---|---|

| Straight bonds | 24/11/2017 | 400 | 24/11/2027 | 1.75% annual Act/Act | AIAF / Luxembourg Stock Exchange |

| Issuer | Corporación de Reservas Estratégicas de Productos Petrolíferos ("CORES") |

|---|---|

| Amount | 400,000,000 € |

| Term | 10 years |

| Maturity date | 24-Nov-27 |

| Coupon | 1.75% annual Act/Act (Payable annually) |

| Nominal unit amount | 100,000 € |

| Issue price | 99.510% |

| Law | Spanish law |

| Quotation market | AIAF Fixed-Income Market, Luxembourg Stock Exchange |

| Issue rating | BBB+ from Fitch, BBB+ from Standard & Poor’s |

| ISIN | ES0224261059 |

| Joint book-runners | BBVA, HSBC, Crédit Agricole CIB, SG CIB |