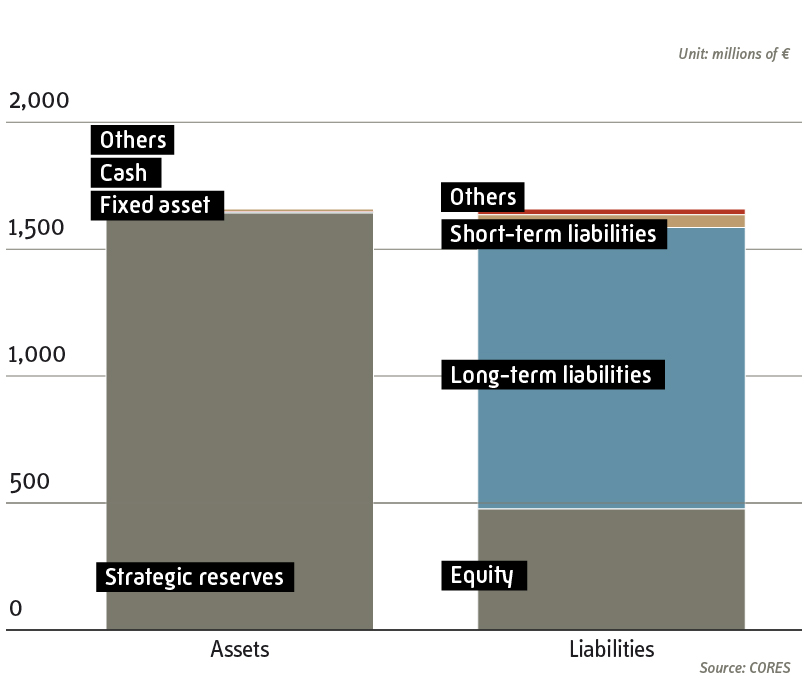

Asset financing

The stockholding obligation to maintain strategic reserves creates the need for financing a high level of stocks.

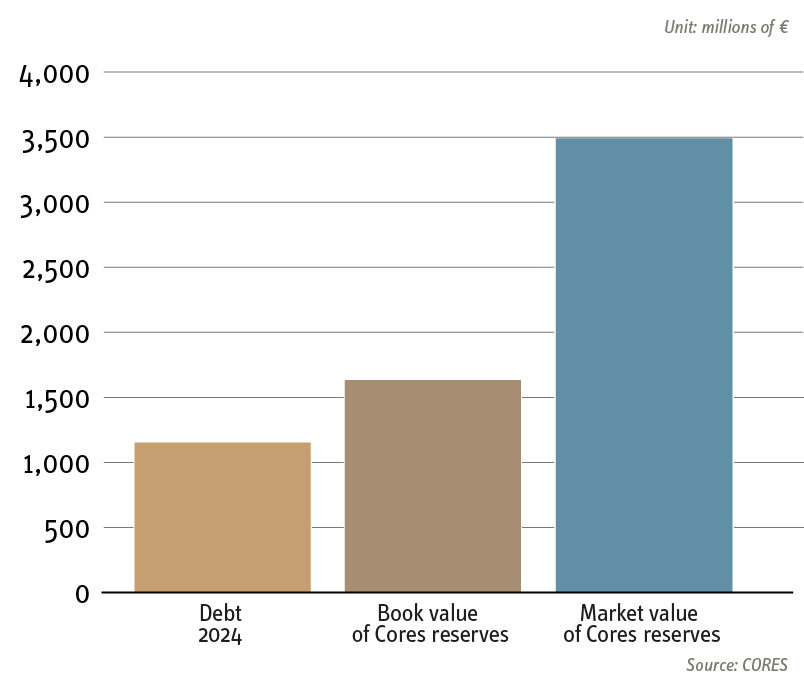

To date, financing for the acquisition of strategic stocks has been achieved with external resources from financial markets through bond issues, loans and credit lines established with different national and international financial institutions.

Balance sheet as of 31st December 2024

The legal framework reinforces the Corporation’s financial solvency: it is mandatory for stocks to be registered at the average acquisition price since its creation. In this way, for accounting purposes, CORES is not affected by the variations in market prices. No correction, depreciation or amortization can be made to the stocks’ historical cost. CORES does not need to make the value corrections that could be revealed because the market price was lower than the acquisition price.

As of December 2023, the market value of CORES’ stock was 2.1 times higher than its average purchase price.